Economics is a highly sophisticated field of thought that is superb at explaining to policymakers precisely why the choices they made in the past were wrong. About the future, not so much. However, careful economic analysis does have one important benefit, which is that it can help kill ideas that are completely logically inconsistent or wildly at variance with the data. This insight covers at least 90 percent of proposed economic policies.The whole thing is worth a read - humour yes, but also quite a bit of wisdom. Speech here, and a video here.

Tuesday 31 March 2015

Bernanke on economics

There's been quite a lot of coverage of former Fed chairman Ben Bernanke starting up a blog and a Twitter account. Someone - apologies, can't remember who - resurrected his 2013 speech, 'The Ten Suggestions', at the Baccalaureate Ceremony at Princeton, where he said of economics

How fast has wealth been growing?

Yesterday I posted about some new data that the Reserve Bank has collated on household balance sheets. It's important stuff, and unsurprisingly other commentators have also been talking about it. As part of the Twittering I rushed in where angels fear to tread, and have subsequently had to shelter in a foxhole in No Man's Land while the salvoes fly over my head.

The debate is about showing the full picture of what has happened to household wealth (and not just sub-sets of the history), and also about the growth rate of household wealth (with some unspoken subtexts, I'm guessing, about who was in government when wealth grew slower or faster).

So in the interests of putting some facts on the table, here are two graphs. They both show the growth rates of GDP and household (net) wealth, and they go back as far as the wealth data do, so this is as full a picture as you can show. Both take rolling four quarter totals, to smooth out the quarterly statistical noise: a side effect is that you lose some quarters at the beginning. And both use year on year growth rates rather than quarter on quarter ones, again to smooth out the noise, which means you lose some more quarters at the beginning, and so the graphs start at December 2000 rather than December 1998 which is when the household wealth series starts.

The only difference is that the first chart shows nominal wealth (the headline dollar number that the RBNZ has calculated) and nominal GDP, so both are in dollars of the day, and the second chart shows real wealth (which is nominal wealth which I have deflated by the CPI) and real GDP (which is Stats data, using the expenditure measure). Both have their uses, and there's already been some cross-fire about which to use, but for many purposes I'd suggest the second graph is likely to be the more relevant. That said, you get much the same shape of growth profile in both cases, so I wouldn't die in a ditch over which one to reach for.

Here they are.

What can you say about these results? First, that wealth is a good deal more volatile than GDP, which is as you'd expect, as asset prices can move a lot across the business cycle. Second, that the current business cycle isn't as strong as the heady days of the early to mid 2000s: GDP is growing respectably at a 2.5-3.0% sort of pace, but it's not as strong as the 4.0-5.0% pace we saw in the early 2000s, and wealth is definitely growing more slowly that it did back then. If people can see other trends in there, let us know.

As for who might get credit or blame, I'll just say what I said in a different context a few days ago - I was talking about jobs but it's as applicable here - that "voters these days know that governments don't create jobs (or not the bulk of them, at any rate). Governments can often, and fairly, take credit for allowing or facilitating or improving the environment for job creation, and that's no small thing: just look at all the counter-examples, from France to Venezuela, where governments have been incompetent managers of the macroeconomic environment. But job creation itself? Nah".

The debate is about showing the full picture of what has happened to household wealth (and not just sub-sets of the history), and also about the growth rate of household wealth (with some unspoken subtexts, I'm guessing, about who was in government when wealth grew slower or faster).

So in the interests of putting some facts on the table, here are two graphs. They both show the growth rates of GDP and household (net) wealth, and they go back as far as the wealth data do, so this is as full a picture as you can show. Both take rolling four quarter totals, to smooth out the quarterly statistical noise: a side effect is that you lose some quarters at the beginning. And both use year on year growth rates rather than quarter on quarter ones, again to smooth out the noise, which means you lose some more quarters at the beginning, and so the graphs start at December 2000 rather than December 1998 which is when the household wealth series starts.

The only difference is that the first chart shows nominal wealth (the headline dollar number that the RBNZ has calculated) and nominal GDP, so both are in dollars of the day, and the second chart shows real wealth (which is nominal wealth which I have deflated by the CPI) and real GDP (which is Stats data, using the expenditure measure). Both have their uses, and there's already been some cross-fire about which to use, but for many purposes I'd suggest the second graph is likely to be the more relevant. That said, you get much the same shape of growth profile in both cases, so I wouldn't die in a ditch over which one to reach for.

Here they are.

|

| Year on year growth rates - nominal $ terms |

|

| Year on year growth rates - real terms |

What can you say about these results? First, that wealth is a good deal more volatile than GDP, which is as you'd expect, as asset prices can move a lot across the business cycle. Second, that the current business cycle isn't as strong as the heady days of the early to mid 2000s: GDP is growing respectably at a 2.5-3.0% sort of pace, but it's not as strong as the 4.0-5.0% pace we saw in the early 2000s, and wealth is definitely growing more slowly that it did back then. If people can see other trends in there, let us know.

As for who might get credit or blame, I'll just say what I said in a different context a few days ago - I was talking about jobs but it's as applicable here - that "voters these days know that governments don't create jobs (or not the bulk of them, at any rate). Governments can often, and fairly, take credit for allowing or facilitating or improving the environment for job creation, and that's no small thing: just look at all the counter-examples, from France to Venezuela, where governments have been incompetent managers of the macroeconomic environment. But job creation itself? Nah".

Monday 30 March 2015

What do we own, and what do we owe?

The Reserve Bank has done everyone a big favour by coming up with improved data on households' assets and liabilities. This latest improvement is part of a series where Rochelle Barrow and her colleagues have been toiling away at finding or improving statistics that throw light on macrofinancial issues - I posted a while back about their extensions to the suite of interest rate data - and it's an especially important one. With the current Auckland housing boom, for example, we need good data on what the vulnerabilities might be in people's balance sheets - have they gone overboard on leveraging into a red-hot market? - and there are also other concerns, including what looks like an unusually low household savings rate by international standards.

You'll find the Bank's news release about the new household data here, the background paper (pdf) that goes into all the technicalities here, and the data themselves (Excel) here and here. By far the major significant improvement is the inclusion of households' equity in small and medium sized businesses (whether incorporated or not). As in many economies, it's a big slab of the economic landscape: in New Zealand households' measured wealth goes up by $312 billion when their business equity is counted. "Goes up", by the way, is meant as a matter of arithmetical comparison between the old data on household wealth and the new ones: households haven't suddenly become much richer, it's just that the RBNZ data are now measuring what was always there, whereas before they weren't.

Here's a snapshot of what New Zealand households own, from the background paper.

The business equity that is now being counted is the darkish blue segment towards the bottom. Housing makes up about half of everything (more like 60% if you add in rental property, which I'll come to in a minute). Whether you regard that as normal, or as yet another illustration of Kiwis' one-eyed preoccupation with housing an as investment, is up to you, but the good news is that, because these new RBNZ statistics are being compiled on an internationally consistent basis, we'll be in a better place to make international comparisons and judge whether we're normal or odd. It won't be a stroll in the park - "Neither the previous New Zealand household sector balance sheet data, nor this new data, will necessarily be fully comparable with data presented by authorities in other countries", as the paper says, partly because other countries have their own funny ways of counting things - but we'll be able to move a good deal closer to making reasonable judgements about how we scrub up compared to other places.

I wondered where our KiwiSavers are, and the answer is, in that purplish segment second one down, 'net equity in superannuation funds'. KiwiSaver came in in 2007, and in December '07 households' equity in super was $31 billion. By December '14 it had risen to $57.8 billion: I know there is recent research from Treasury saying KiwiSaver didn't add to overall wealth accumulation, and perhaps KiwiSaver only shifted around how wealth is held, and maybe that's right. But in any event there's now a sizeable KiwiSaver pot where there wasn't one before.

Unfortunately, one of the side effects of moving to an internationally standardised way of measuring these things is that rental property - which you and I would regard as an archetypal household asset - is classified as a business activity rather than a household activity in the international Book of Armaments. As the background paper says, "most analysts will want to include the liabilities of rental properties as household liabilities because of the full-recourse nature of mortgages in New Zealand", and so the Bank "will continue to provide statistics that include rental property as an adjunct to the new series". Jolly good.

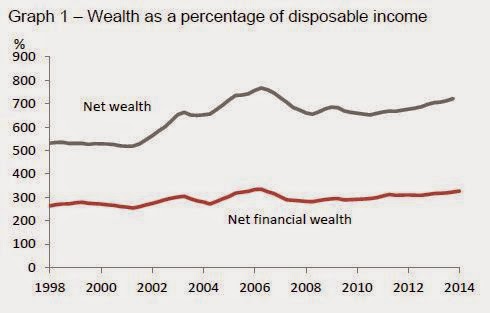

The only quibble I've got - and I had it about the older less complete data, too - is that I think the headline way of summarising the data doesn't really show the situation in the intuitive way most of us would like to see. It's got its uses, I dare say, but it doesn't hit the spot for me. Here, for example, is one of the RBNZ's summary graphs.

There's net wealth at the top - fine, got that, your total assets less your total liabilities, no problem there. And then there's net financial wealth, which is your financial assets (money in the bank, the KiwiSaver, those Mighty River Power shares) less your financial liabilities (the mortgage, the credit card). But I'm afraid I find the net financial wealth calculation of no practical interest or utility at all: it makes more sense to me to net off the financial liability of the mortgage against the non-financial asset of the house (to show housing equity) and to show financial assets net of any other financial liabilities.

Here's my rejig, including rental property and mortgages secured against rental property. It's horses for courses, but for me this is a better way of showing how much we've got in the house and how much in other things. Indirectly, though, it shows, again, the utility of the data, as they can be spliced and diced to suit your interest.

You'll find the Bank's news release about the new household data here, the background paper (pdf) that goes into all the technicalities here, and the data themselves (Excel) here and here. By far the major significant improvement is the inclusion of households' equity in small and medium sized businesses (whether incorporated or not). As in many economies, it's a big slab of the economic landscape: in New Zealand households' measured wealth goes up by $312 billion when their business equity is counted. "Goes up", by the way, is meant as a matter of arithmetical comparison between the old data on household wealth and the new ones: households haven't suddenly become much richer, it's just that the RBNZ data are now measuring what was always there, whereas before they weren't.

Here's a snapshot of what New Zealand households own, from the background paper.

The business equity that is now being counted is the darkish blue segment towards the bottom. Housing makes up about half of everything (more like 60% if you add in rental property, which I'll come to in a minute). Whether you regard that as normal, or as yet another illustration of Kiwis' one-eyed preoccupation with housing an as investment, is up to you, but the good news is that, because these new RBNZ statistics are being compiled on an internationally consistent basis, we'll be in a better place to make international comparisons and judge whether we're normal or odd. It won't be a stroll in the park - "Neither the previous New Zealand household sector balance sheet data, nor this new data, will necessarily be fully comparable with data presented by authorities in other countries", as the paper says, partly because other countries have their own funny ways of counting things - but we'll be able to move a good deal closer to making reasonable judgements about how we scrub up compared to other places.

I wondered where our KiwiSavers are, and the answer is, in that purplish segment second one down, 'net equity in superannuation funds'. KiwiSaver came in in 2007, and in December '07 households' equity in super was $31 billion. By December '14 it had risen to $57.8 billion: I know there is recent research from Treasury saying KiwiSaver didn't add to overall wealth accumulation, and perhaps KiwiSaver only shifted around how wealth is held, and maybe that's right. But in any event there's now a sizeable KiwiSaver pot where there wasn't one before.

Unfortunately, one of the side effects of moving to an internationally standardised way of measuring these things is that rental property - which you and I would regard as an archetypal household asset - is classified as a business activity rather than a household activity in the international Book of Armaments. As the background paper says, "most analysts will want to include the liabilities of rental properties as household liabilities because of the full-recourse nature of mortgages in New Zealand", and so the Bank "will continue to provide statistics that include rental property as an adjunct to the new series". Jolly good.

The only quibble I've got - and I had it about the older less complete data, too - is that I think the headline way of summarising the data doesn't really show the situation in the intuitive way most of us would like to see. It's got its uses, I dare say, but it doesn't hit the spot for me. Here, for example, is one of the RBNZ's summary graphs.

There's net wealth at the top - fine, got that, your total assets less your total liabilities, no problem there. And then there's net financial wealth, which is your financial assets (money in the bank, the KiwiSaver, those Mighty River Power shares) less your financial liabilities (the mortgage, the credit card). But I'm afraid I find the net financial wealth calculation of no practical interest or utility at all: it makes more sense to me to net off the financial liability of the mortgage against the non-financial asset of the house (to show housing equity) and to show financial assets net of any other financial liabilities.

Here's my rejig, including rental property and mortgages secured against rental property. It's horses for courses, but for me this is a better way of showing how much we've got in the house and how much in other things. Indirectly, though, it shows, again, the utility of the data, as they can be spliced and diced to suit your interest.

While a statistician's work is never done, it looks as if these enhancements to the household picture have largely filled in the one large big gap: the background picture notes some possible future extensions but I doubt if they're going to be of the order of $312 billion worth (though converting the SME equity from its current book value to market value could be worth a bob or two to the picture of household equity). We're now in a clearly better place when it comes to having a good picture of household wealth and debt - well done, the RB.

Saturday 28 March 2015

A must-read report on people's attitudes to competition

Economists sometimes get taken to task for wishing competition onto people, and there are often proponents of the idea that there are less divisive and less conflicting, or more collegial and more cooperative, approaches to life.

So it's extraordinarily useful to have a comprehensive survey of what a large group of people actually think about competition. It covers the Eurozone, and it's the latest in the European Commission's series of what they call Flash Eurobarometers, or "ad hoc thematical telephone interviews conducted at the request of any service of the European Commission. Flash surveys enable the Commission to obtain results relatively quickly and to focus on specific target groups, as and when required".

This latest one is on "Citizens' Perception about Competition Policy", and it's terrific. If you've got the slightest interest in competition, it's a must-read. The summary is here (pdf) and the full report is here (also pdf).

First of all, let's deal to the canard that people would prefer the quiet cooperative life without the jostle or hassle. The two graphs below say it all.

It's also true that people can see the other side of the coin, and are fully aware of the downside of having inadequate competition, as this graph shows.

That's the guts of the results, but there's lots more that's also fascinating. For example, some competition authorities - including, I'd suggest, our own - take the view that it's too hard to measure the state of competition, and if you wanted to, you could certainly convince yourself that HHIs are imperfect and you can't measure price to marginal cost and so on and so forth. Funny, though, that the person in the street in Paris or Prague doesn't have much difficulty seeing a lack of competition when it sneaks up on them, as this next graph shows.

So it's extraordinarily useful to have a comprehensive survey of what a large group of people actually think about competition. It covers the Eurozone, and it's the latest in the European Commission's series of what they call Flash Eurobarometers, or "ad hoc thematical telephone interviews conducted at the request of any service of the European Commission. Flash surveys enable the Commission to obtain results relatively quickly and to focus on specific target groups, as and when required".

This latest one is on "Citizens' Perception about Competition Policy", and it's terrific. If you've got the slightest interest in competition, it's a must-read. The summary is here (pdf) and the full report is here (also pdf).

First of all, let's deal to the canard that people would prefer the quiet cooperative life without the jostle or hassle. The two graphs below say it all.

It's also true that people can see the other side of the coin, and are fully aware of the downside of having inadequate competition, as this graph shows.

That's the guts of the results, but there's lots more that's also fascinating. For example, some competition authorities - including, I'd suggest, our own - take the view that it's too hard to measure the state of competition, and if you wanted to, you could certainly convince yourself that HHIs are imperfect and you can't measure price to marginal cost and so on and so forth. Funny, though, that the person in the street in Paris or Prague doesn't have much difficulty seeing a lack of competition when it sneaks up on them, as this next graph shows.

You couldn't ask for a better roadmap of competition problems (and indeed you could easily see how repeated surveys along these lines would help show any competition authority whether it is making progress).

And it gets better: if you go to the full report, you can see the country/sector breakdowns where you can immediately identify the hot spots. If the European Commission was born anew today, knowing nothing whatever about the state of competition across the Eurozone, in five minutes it would establish (from pp17-21 of the full report) that it should be looking at the energy sector in Bulgaria, Cyprus and Latvia; at the transport sector in France, Finland and Ireland; at the pharmaceutical sector in France, Ireland and the Netherlands; at telecoms and the internet in Croatia, Belgium and Spain; at food distribution in Finland, Greece and Lithuania; and at financial services in France, Ireland and Denmark. That's an immensely powerful guide to competition policy and enforcement priorities, and a very suggestive input into the kinds of structural reforms many of these countries need to undertake.

I won't go on much further: it's a great report, and you should really read it for yourself. I'll finish with just one final, and I thought somewhat poignant, point, and that's how attitudes to competition have changed. Some of those countries in the EU28 are relatively recent converts to the market economy, and back in 2009, when the previous survey was run, there were, for obvious reasons, relatively high levels of "don't have a clue, mate" responses to how competition feels and what it does or does not achieve.

Fast forward to 2014, when this latest survey was taken, and the "don't knows" have shrunk. In Romania, for example, they used to make up 16% of the populace: now it's only 2%. And where did those votes go? Overwhelmingly towards a more positive view of competition: when exposed to the wicked market ways of the West, 90% of Romanians now agree that competition gives consumers more choice, a 17% rise in just five years. Those who disagree have dropped from 11% to 8%. And there are similar shifts in opinion in Hungary, Lithuania, Bulgaria and Estonia, and smaller shifts in the same positive direction in Poland and Latvia.

It's not completely universal: the Czechs, for example, don't seem to have made much of a success of their move to a more market economy. But as a general rule when people who have never had decent choice or fair prices get them, they love it. Something to remember for the next time a politician is afraid of the backlash from some protected group whose privileges are being exposed to competition: the vast majority of citizens will be behind you.

Friday 27 March 2015

Lies, damned lies, and durables orders

There are days when you really, really wonder about the efficiency of the financial markets.

Apparently (according to the AP coverage), US shares have been sold off because "Traders were discouraged to see that orders for long-lasting manufactured goods fell in February for the third time in four months". The weak state of US durables orders appears to be having effects closer to home too, with the Sydney Morning Herald saying yesterday that "The [ASX] market was down from the opening bell as Wall Street stocks were sold off sharply after unexpectedly weak US durable goods orders".

Could everyone get a grip, please?

Here are the durables data they're all supposedly worried about (from the terrific, and free, FRED data resource that the St Louis Fed provides).

Over longer timeframes, the monthly changes in the durables orders series are pretty much useless as a cyclical guide. You did get a run of consecutive falls in the post-GFC recession (the darker shaded area in the graph), but that's it. Even in what is now a prolonged recovery, you don't get a corresponding clear string of good durables numbers: if there is one in there somewhere, it's been well hidden by the monthly volatility.

It's even worse if you're not taking the longer view. Here's the past couple of years on their own.

The volatility is very large: 4% or 5% moves up or down in a single month are quite common, with the occasional even larger humdinger to throw you completely like that 22.6% spike in July '14 (some huge order for transport equipment, as it transpired).

So the noise is immense, and the signal (if there is one) is inaudible. I know journalists have to write something to keep the ads apart, and economists and analysts have to do something in the office till the pubs open, but durable goods orders? Really?

Apparently (according to the AP coverage), US shares have been sold off because "Traders were discouraged to see that orders for long-lasting manufactured goods fell in February for the third time in four months". The weak state of US durables orders appears to be having effects closer to home too, with the Sydney Morning Herald saying yesterday that "The [ASX] market was down from the opening bell as Wall Street stocks were sold off sharply after unexpectedly weak US durable goods orders".

Could everyone get a grip, please?

Here are the durables data they're all supposedly worried about (from the terrific, and free, FRED data resource that the St Louis Fed provides).

Over longer timeframes, the monthly changes in the durables orders series are pretty much useless as a cyclical guide. You did get a run of consecutive falls in the post-GFC recession (the darker shaded area in the graph), but that's it. Even in what is now a prolonged recovery, you don't get a corresponding clear string of good durables numbers: if there is one in there somewhere, it's been well hidden by the monthly volatility.

It's even worse if you're not taking the longer view. Here's the past couple of years on their own.

The volatility is very large: 4% or 5% moves up or down in a single month are quite common, with the occasional even larger humdinger to throw you completely like that 22.6% spike in July '14 (some huge order for transport equipment, as it transpired).

So the noise is immense, and the signal (if there is one) is inaudible. I know journalists have to write something to keep the ads apart, and economists and analysts have to do something in the office till the pubs open, but durable goods orders? Really?

Thursday 26 March 2015

Wings clipped. Good

On Tuesday the ACCC said it was minded not to allow a proposed coordination agreement between Qantas and China Eastern on the Sydney-Shanghai route (media release here, full draft decision as a pdf here).

Good. It was hard to see how they could find otherwise as the likely detriments were large and the benefits (though real) small in comparison. As the Summary of the decision noted

Good. It was hard to see how they could find otherwise as the likely detriments were large and the benefits (though real) small in comparison. As the Summary of the decision noted

Qantas and China Eastern had a combined share of capacity (seats flown) on the Sydney – Shanghai route of 83% over the 12-month period from October 2013 to September 2014

...the ACCC considers that Qantas and China Eastern are the major carriers on the Sydney – Shanghai route and each other’s closest competitors. The competitive constraint they impose on each other is likely to be lost if the Proposed Conduct proceeds.

For these reasons the ACCC considers that the Proposed Conduct is likely to result in significant public detriment. It is likely to give Qantas and China Eastern an increased ability and incentive to unilaterally reduce capacity, or limit growth in capacity, relative to that which would occur in the absence of the Proposed Conduct, thereby allowing the Applicants to increase airfares on the Sydney – Shanghai route

The ACCC considers that the Proposed Conduct is likely to result in a range of public benefits. However, the ACCC considers that the magnitude of these benefits is likely to be limited.

The ACCC considers that on the Sydney – Shanghai route the extent of the reduction in competition, and associated public detriment, is likely to be significant and outweigh any benefits of the Proposed Conduct.The airline industry, left to its own devices, can be too clubbable by half, and there's a very strong argument for regulators outside the industry, like the ACCC or the Commerce Commission, to be an arbiter of proposals like these: we need someone to take the pro-consumer, and not just the pro-industry, line. I don't know exactly what "regulatory approvals" Air New Zealand says it needs for its proposed coordination with Air China, but I hope they include our competition authority.

Playing monopoly

Monopoly is in the air. The kiwi fruit people want more of it: the Herald's coverage of their recent industry poll is here - where I learned that the polite word for "monopoly" these days in kiwifruit circles is "single point of entry" - and the meat industry would like some, too.

That's one of the core recommendations in a recent report by Meat Industry Excellence (and I should tip a hat in the direction of John Small's website, where I first saw mention of it). They're a ginger group who describe themselves as "passionate farmers and industry supporters who can clearly see the opportunities (and the barriers to progress) for our red meat sector. They are a diverse group who are prepared to stand up, collaborate and work with farmers and industry to create sustainable profitability for all players".

Fair enough, and actually I have some sympathy for their diagnosis of what ails the meat industry and for their vision of creating and capturing high value add through a focus on the end consumer (though if you can also hear the hoofbeats of a "But" galloping towards us, you're right). Stock numbers have dropped sharply, stranding processing assets, which means that a deadly game of musical chairs is underway. Processors are playing over the odds to get stock through their plant rather than the other fellow's, adding to the financial costs of carrying the surplus capacity, and leaving nothing over to pay for the marketing and innovation that would raise industry incomes all along the value chain (there's an argument that that the processors were never that good at the marketing end even in better times, but that's for another day).

Their suggested ways forward are some combination of industry aggregation (to something like a Fonterra-sized processor), a collective approach to rationalisation of the spare capacity including a cunning plan, 'chain licensing', which would cap capacity, and a collective or coordinated approach to export marketing, perhaps along Zespri lines. That's my potted summary: Rod Oram's got one here, and Lincoln's Agribusiness and Economics Research Unit have a rather longer one here.

What bothers me about this is the strong lean towards monopoly market solutions at the expense of competitive market solutions. It's not universal: the draft paper on the chain licensing says, for example, that

One is that there are, in fact, good working examples of thriving, competition-based, agricultural export industries, with the outstanding example being our own wine industry (and arguably another in the making, in the craft beer trade). And the French wine and cheese trades successfully get their Cotes du Rhone and Roquefort to me using exactly that model of large numbers of French companies competing against each other for the same overseas customers that is supposedly the "problem" that the Zespri route is meant to "solve". So it's by no means a given that Fonterra-style or Zespri-style models beat market models, where competing companies are forced to add value and to innovate to succeed. And it is worth remembering that the Commerce Commission, when the original Fonterra idea came through their door in 1999 before the thing got its own legislation, found that "the Commission has reached the preliminary view that it cannot be satisfied that the public benefits of the proposed merger are likely to outweigh the competitive detriments".

And the other is that chain of links that goes: create a monopoly, generate more profit, use the money to fund product and market development. You can certainly do the first two, but the third leg looks highly suspect. A monopoly is just about the last organisational form you would expect to be highly consumer-focussed and highly innovative. We've got the magnificent diversity of our premium wine offerings, very largely driven by micro, small and medium-sized companies, all jostling with their ideas in the marketplace: does anyone seriously believe a Wine Export Board would have achieved a tenth of that success?

That's one of the core recommendations in a recent report by Meat Industry Excellence (and I should tip a hat in the direction of John Small's website, where I first saw mention of it). They're a ginger group who describe themselves as "passionate farmers and industry supporters who can clearly see the opportunities (and the barriers to progress) for our red meat sector. They are a diverse group who are prepared to stand up, collaborate and work with farmers and industry to create sustainable profitability for all players".

Fair enough, and actually I have some sympathy for their diagnosis of what ails the meat industry and for their vision of creating and capturing high value add through a focus on the end consumer (though if you can also hear the hoofbeats of a "But" galloping towards us, you're right). Stock numbers have dropped sharply, stranding processing assets, which means that a deadly game of musical chairs is underway. Processors are playing over the odds to get stock through their plant rather than the other fellow's, adding to the financial costs of carrying the surplus capacity, and leaving nothing over to pay for the marketing and innovation that would raise industry incomes all along the value chain (there's an argument that that the processors were never that good at the marketing end even in better times, but that's for another day).

Their suggested ways forward are some combination of industry aggregation (to something like a Fonterra-sized processor), a collective approach to rationalisation of the spare capacity including a cunning plan, 'chain licensing', which would cap capacity, and a collective or coordinated approach to export marketing, perhaps along Zespri lines. That's my potted summary: Rod Oram's got one here, and Lincoln's Agribusiness and Economics Research Unit have a rather longer one here.

What bothers me about this is the strong lean towards monopoly market solutions at the expense of competitive market solutions. It's not universal: the draft paper on the chain licensing says, for example, that

Competition and choice at the farm gate must remain. Animosity by some processors against competition is misplaced.

Competition is essential for the Industry. It is overcapacity and lower livestock numbers which has led to the low plant utilization within the Industry...Marginal pricing, refusal to close plants because of high redundancy costs, focus on throughput and fixed cost amortization, excessive use of third party buying agents, and adding extra capacity are all competitive responses that are rational within the current structure of so much additional capacity. They result not from the principle of competition but from overcapacityBut otherwise it's pretty much pervasive among those casting around for potential ways forward to reach for Fonterra and/or Zespri as proven models from other industries. Fortunately, some of these ideas are non-starters. Animosities and incompatibilities among the processors likely put the kibosh on all the grander schemes of agglomeration, as would the Commerce Commission, since I don't see the required authorisation as likely to be forthcoming: orchestrated stitch-ups to create monopsony power against suppliers and monopoly power against consumers rarely get the nod, and for good reason. And the chain licensing idea would also need some get of jail free card, as it too looks bang to rights under the Commerce Act. But even if they were enabled through the meat industry equivalent of the legislation that created Fonterra, they look to me to be the wrong approach, for two reasons.

One is that there are, in fact, good working examples of thriving, competition-based, agricultural export industries, with the outstanding example being our own wine industry (and arguably another in the making, in the craft beer trade). And the French wine and cheese trades successfully get their Cotes du Rhone and Roquefort to me using exactly that model of large numbers of French companies competing against each other for the same overseas customers that is supposedly the "problem" that the Zespri route is meant to "solve". So it's by no means a given that Fonterra-style or Zespri-style models beat market models, where competing companies are forced to add value and to innovate to succeed. And it is worth remembering that the Commerce Commission, when the original Fonterra idea came through their door in 1999 before the thing got its own legislation, found that "the Commission has reached the preliminary view that it cannot be satisfied that the public benefits of the proposed merger are likely to outweigh the competitive detriments".

And the other is that chain of links that goes: create a monopoly, generate more profit, use the money to fund product and market development. You can certainly do the first two, but the third leg looks highly suspect. A monopoly is just about the last organisational form you would expect to be highly consumer-focussed and highly innovative. We've got the magnificent diversity of our premium wine offerings, very largely driven by micro, small and medium-sized companies, all jostling with their ideas in the marketplace: does anyone seriously believe a Wine Export Board would have achieved a tenth of that success?

Thursday 19 March 2015

We are not alone

We all know that demand for housing in Auckland is high, and supply is scarce. As the Governor of the Reserve Bank put it in a speech in February

While the report, and the Council, are rather critical of local authorities' performance in issuing enough building consents, that doesn't seem entirely fair to me. Look at Canterbury in the table. According to the Great Plan From On High, Canterbury was supposed to issue building consents for 263 dwellings a year (column 1 of data). In the event it actually issued 324 (column 2), and got a gold star for achieving 123% of target (column 3) with 61 more than needed (column 4).

Unfortunately for the Canterbury planning office, however, those damn cussed humans weren't following the Great Plan when it came to deciding where to live. Far more of them were actually living in Canterbury than the Great Plan favoured: ideally there should have been 611 new dwelling projects consented to house the actual inhabitants (column 5). Building consents were 287 less (column 6) than actually needed, or only 53% (column 7) of what they needed to be. So rents and prices soared, and living space became tighter, as people were forced to scrunch up with their families, friends and flatmates. People, in short, didn't want to buy what the Great Plan was selling.

So yes, there is still an issue of local authorities not reacting to the actual demand for housing with enough consents in good time (though to be fair, the likes of Canterbury may well have felt constrained to stick to somewhere in the general vicinity of the Great Plan). And the planning process in Sydney is as rickety and slow and expensive and inconsistent as it is here: if you're into the microminutiae of planning processes the MacroPlan report has some detailed suggestions for improvement on page 28, most of which look as if they would be equally applicable to us, including "A broad scale review of employment trends and new employment needs in conjunction with housing needs — to identify land-use opportunities for housing development such as rezoning disused

industrial lands to residential", and "A more responsive development assessment system that curbs costs and recognises that ‘speed to market’ is crucial".

But there's also the bigger issue of getting a better match between the Great Plans of this world and what people will actually sign up for. I can see value to a Great Plan from a variety of environmental, social and economic perspectives (coordination with infrastructure investment, for example). And no doubt many planners would say that their Great Plan is the end result of extensive community consultation, and at some level is what the people want. Well, maybe. But in Sydney at least - and maybe Auckland planning aficionados will chip in about the situation closer to home - it hasn't turned out that way.

Auckland’s housing shortage is estimated to have increased over the past year to between 15,000 and 20,000 dwellings, and the Auckland Council estimates that 10,000 houses a year will be required for the next 3 decades. Residential building permits are currently running at an annual rate of 7,700 – a 70 percent increase over 2012 and twice the 2011 level, but well short of the increase that needs to be sustained over a long period.What people may not know is that our problem is not unique: Sydney's exactly the same, as a recent report prepared by MacroPlan Dimasi for the Property Council of Australia shows. Here's the guts of the findings, from the Property Council's press release, and the full report is here as a pdf.

Here's an extract from the key Table 2 in the report which seemed to me to be quite interesting.

While the report, and the Council, are rather critical of local authorities' performance in issuing enough building consents, that doesn't seem entirely fair to me. Look at Canterbury in the table. According to the Great Plan From On High, Canterbury was supposed to issue building consents for 263 dwellings a year (column 1 of data). In the event it actually issued 324 (column 2), and got a gold star for achieving 123% of target (column 3) with 61 more than needed (column 4).

Unfortunately for the Canterbury planning office, however, those damn cussed humans weren't following the Great Plan when it came to deciding where to live. Far more of them were actually living in Canterbury than the Great Plan favoured: ideally there should have been 611 new dwelling projects consented to house the actual inhabitants (column 5). Building consents were 287 less (column 6) than actually needed, or only 53% (column 7) of what they needed to be. So rents and prices soared, and living space became tighter, as people were forced to scrunch up with their families, friends and flatmates. People, in short, didn't want to buy what the Great Plan was selling.

So yes, there is still an issue of local authorities not reacting to the actual demand for housing with enough consents in good time (though to be fair, the likes of Canterbury may well have felt constrained to stick to somewhere in the general vicinity of the Great Plan). And the planning process in Sydney is as rickety and slow and expensive and inconsistent as it is here: if you're into the microminutiae of planning processes the MacroPlan report has some detailed suggestions for improvement on page 28, most of which look as if they would be equally applicable to us, including "A broad scale review of employment trends and new employment needs in conjunction with housing needs — to identify land-use opportunities for housing development such as rezoning disused

industrial lands to residential", and "A more responsive development assessment system that curbs costs and recognises that ‘speed to market’ is crucial".

But there's also the bigger issue of getting a better match between the Great Plans of this world and what people will actually sign up for. I can see value to a Great Plan from a variety of environmental, social and economic perspectives (coordination with infrastructure investment, for example). And no doubt many planners would say that their Great Plan is the end result of extensive community consultation, and at some level is what the people want. Well, maybe. But in Sydney at least - and maybe Auckland planning aficionados will chip in about the situation closer to home - it hasn't turned out that way.

Thursday 12 March 2015

Maybe a boom isn't what it used to be

Fascinating webcast of the media conference after the RBNZ's Monetary Policy Statement this morning (if you missed it live, there'll be a recording available here by close of play today).

The big thing I took away was the possibility of structural change - 'structural change' being economese for when the pre-existing relationships in the economy don't behave they way they used to and start doing less, or more, or happening faster or more slowly, or vanish completely, or indeed change to doing the opposite of what used to happen.

This is potentially a big issue for the RBNZ in setting policy. If the old relationships hold about wage and price setting behaviour, then our currently buoyant economy could well be leading to higher prices and wages, especially in the non-traded sector, where people setting prices and wages won't be held in check by the discipline of competition from imports. So the Bank would need to stay in "we're watching you very carefully, yes you over there, we can see you" mode, with the potential stick of higher interest rates in the background to restore order.

But what if that traditional link between boom times and boom time wages is nowhere near as strong? Then the Bank is overworried about something that isn't going to happen, or put another way, it's got monetary policy too tight. And so far non-tradables inflation is looking lower than you might have thought it would be in this strong economy, as you can see in the graph below, taken from the Statement. At the fag end of the mid 2000s boom, non-tradable inflation had blown out to 4.5%. In the current boom, it's 2.5%, and if anything falling.

And maybe the same thing is happening elsewhere. The Bank also included this graph, showing recent wage/earnings growth in the US, where they're having a sustained run of strong employment growth. As the Bank commented (p14), "Despite the significant decline in the unemployment rate over recent years, growth in nominal wages remains low relative to history".

You have to be careful about 'structural change': it can become an easy, lazy and unverifiable, way of explaining anything you didn't expect. But I suspect - and I suspect the Bank suspects - that there's something in this new story of wage and price setting not blowing out in booms like it used to..

The big thing I took away was the possibility of structural change - 'structural change' being economese for when the pre-existing relationships in the economy don't behave they way they used to and start doing less, or more, or happening faster or more slowly, or vanish completely, or indeed change to doing the opposite of what used to happen.

This is potentially a big issue for the RBNZ in setting policy. If the old relationships hold about wage and price setting behaviour, then our currently buoyant economy could well be leading to higher prices and wages, especially in the non-traded sector, where people setting prices and wages won't be held in check by the discipline of competition from imports. So the Bank would need to stay in "we're watching you very carefully, yes you over there, we can see you" mode, with the potential stick of higher interest rates in the background to restore order.

But what if that traditional link between boom times and boom time wages is nowhere near as strong? Then the Bank is overworried about something that isn't going to happen, or put another way, it's got monetary policy too tight. And so far non-tradables inflation is looking lower than you might have thought it would be in this strong economy, as you can see in the graph below, taken from the Statement. At the fag end of the mid 2000s boom, non-tradable inflation had blown out to 4.5%. In the current boom, it's 2.5%, and if anything falling.

And maybe the same thing is happening elsewhere. The Bank also included this graph, showing recent wage/earnings growth in the US, where they're having a sustained run of strong employment growth. As the Bank commented (p14), "Despite the significant decline in the unemployment rate over recent years, growth in nominal wages remains low relative to history".

You have to be careful about 'structural change': it can become an easy, lazy and unverifiable, way of explaining anything you didn't expect. But I suspect - and I suspect the Bank suspects - that there's something in this new story of wage and price setting not blowing out in booms like it used to..

Tuesday 10 March 2015

There has to be a better way. And there is

I'm convinced there's a better way to get a good fix on some of our more contentious, and important, regulated telecoms prices. Let's deal to some jargon first, and then we'll get properly underway.

If you've got broadband, you get it from an Internet Service Provider (your ISP). And chances are it arrives over the copper wire phone line to your house. You could be on wireless broadband, or you might have signed up for the flashy new fibre network that's being rolled out, but most of us are still on the old copper based system. It's owned by Chorus, and your ISP pays Chorus for the use of that copper line from your house to the nearest telephone exchange. That service is known as the Unbundled Copper Local Loop, or UCLL. ISPs can put their own equipment in the exchange and take the feed from there, or they can rent some gear from Chorus instead of providing their own: that's the Unbundled Bitstream Access service, or UBA.

And finally - and this is where things come closer to your wallet - you've likely noticed that your ISP has said it'll be raising its price to you by $4 a month or so, because the Commerce Commission, which regulates the copper line UCLL price, is in the process of raising it from $23.52 a month (its first stab at the right price to charge) to $28.42 a month (its estimate after going through a full cost modelling exercise).

There's a consultation process going on before the Commission's proposed UCLL goes final (all you can eat here). As part of that process, Spark has come up with this graph, which shows how the Commission's proposed price compares with the price charged for the same service in a range of other developed countries.

You may have seen this already - the Herald's technology columnist, Chris Barton ran with it in a recent article, "Something rotten in our Commerce Commission", where among other things he concluded that "by a curious combination [of] free market ideology and caving to political pressure, it's [i.e. the Commission is] promoting monopoly power and a haughty "let them [the end-users] eat cake"." No doubt the Commissioners sacrifice children to the Great Werewolf, too.

In any event the graph does give you pause for thought about various aspects of how telco prices are set by regulation. My main point: I think there's greater room for using information on overseas prices as a guide to setting our own.

We do it a bit, at the moment: that "first stab" the Commission had at setting the price was required, under our Telecommunications Act, to be set by "benchmarking" against prices overseas. Unfortunately the benchmarking was tightly circumscribed in the Act, and had to be "Benchmarking against prices for similar services in comparable countries that use a forward-looking cost-based pricing method".

You can understand the logic. You wouldn't want prices to be set here solely on the basis of countries that weren't at all like us (eg a highly dense conurbation like Hong Kong), hence the "comparable" test, and you wouldn't want prices to be imported into New Zealand that had all been plucked out of the air on some cockamamie basis. And that's a real risk: regulatory proceedings can easily get captured by one vested interest or another. Money politics can see incumbents' prices set on too-favourable terms; populist politics can set prices that don't cover incumbents' costs. So you can see why the legislation saw fit to use prices only if they were set in a particular way.

Trouble is, you can take intellectual purity too far. After filtering according to the Act, the latest benchmarking exercise, for the UBA service, ended up with only Denmark and Sweden to look at, which left everyone feeling a bit uneasy. I doubt if even the framers of the Act would have liked a benchmarking process that featured only two smallish Scandinavian countries.

So why don't we take a different tack? Why don't we go the Spark route, and look at the whole range of prices overseas? It would make sense to keep some element of comparability, so we might want to restrict it to say the OECD countries, but even that would leave us with a largeish group of 33. Some prices may well be off, and unfairly tilted towards suppliers or consumers, but on average you'd be inclined to think that the truth will appear somewhere in the middle. You might worry that New Zealand has got some special features that make it impracticable to compare with the average overseas experience: people like to raise the "long and stringy" argument, for example (though you'd think places like Norway and Sweden are much the same). All I can say is that I've seen a lot of folks argue both sides of the "New Zealand is unique" case, and I still don't see a knock-out case for our conditions being completely idiosyncratic.

Regular readers - God bless both of you - will know that I've banged on before (for example here and here) about using benchmarking more extensively in our price regulation, and I'd like to see our revised telco regime, when it eventually materialises, reaching more often for the regulatory equivalent of Number 8 fencing wire. It may be low tech, but it's admirably cheap and serviceable.

If you've got broadband, you get it from an Internet Service Provider (your ISP). And chances are it arrives over the copper wire phone line to your house. You could be on wireless broadband, or you might have signed up for the flashy new fibre network that's being rolled out, but most of us are still on the old copper based system. It's owned by Chorus, and your ISP pays Chorus for the use of that copper line from your house to the nearest telephone exchange. That service is known as the Unbundled Copper Local Loop, or UCLL. ISPs can put their own equipment in the exchange and take the feed from there, or they can rent some gear from Chorus instead of providing their own: that's the Unbundled Bitstream Access service, or UBA.

And finally - and this is where things come closer to your wallet - you've likely noticed that your ISP has said it'll be raising its price to you by $4 a month or so, because the Commerce Commission, which regulates the copper line UCLL price, is in the process of raising it from $23.52 a month (its first stab at the right price to charge) to $28.42 a month (its estimate after going through a full cost modelling exercise).

There's a consultation process going on before the Commission's proposed UCLL goes final (all you can eat here). As part of that process, Spark has come up with this graph, which shows how the Commission's proposed price compares with the price charged for the same service in a range of other developed countries.

You may have seen this already - the Herald's technology columnist, Chris Barton ran with it in a recent article, "Something rotten in our Commerce Commission", where among other things he concluded that "by a curious combination [of] free market ideology and caving to political pressure, it's [i.e. the Commission is] promoting monopoly power and a haughty "let them [the end-users] eat cake"." No doubt the Commissioners sacrifice children to the Great Werewolf, too.

In any event the graph does give you pause for thought about various aspects of how telco prices are set by regulation. My main point: I think there's greater room for using information on overseas prices as a guide to setting our own.

We do it a bit, at the moment: that "first stab" the Commission had at setting the price was required, under our Telecommunications Act, to be set by "benchmarking" against prices overseas. Unfortunately the benchmarking was tightly circumscribed in the Act, and had to be "Benchmarking against prices for similar services in comparable countries that use a forward-looking cost-based pricing method".

You can understand the logic. You wouldn't want prices to be set here solely on the basis of countries that weren't at all like us (eg a highly dense conurbation like Hong Kong), hence the "comparable" test, and you wouldn't want prices to be imported into New Zealand that had all been plucked out of the air on some cockamamie basis. And that's a real risk: regulatory proceedings can easily get captured by one vested interest or another. Money politics can see incumbents' prices set on too-favourable terms; populist politics can set prices that don't cover incumbents' costs. So you can see why the legislation saw fit to use prices only if they were set in a particular way.

Trouble is, you can take intellectual purity too far. After filtering according to the Act, the latest benchmarking exercise, for the UBA service, ended up with only Denmark and Sweden to look at, which left everyone feeling a bit uneasy. I doubt if even the framers of the Act would have liked a benchmarking process that featured only two smallish Scandinavian countries.

So why don't we take a different tack? Why don't we go the Spark route, and look at the whole range of prices overseas? It would make sense to keep some element of comparability, so we might want to restrict it to say the OECD countries, but even that would leave us with a largeish group of 33. Some prices may well be off, and unfairly tilted towards suppliers or consumers, but on average you'd be inclined to think that the truth will appear somewhere in the middle. You might worry that New Zealand has got some special features that make it impracticable to compare with the average overseas experience: people like to raise the "long and stringy" argument, for example (though you'd think places like Norway and Sweden are much the same). All I can say is that I've seen a lot of folks argue both sides of the "New Zealand is unique" case, and I still don't see a knock-out case for our conditions being completely idiosyncratic.

Regular readers - God bless both of you - will know that I've banged on before (for example here and here) about using benchmarking more extensively in our price regulation, and I'd like to see our revised telco regime, when it eventually materialises, reaching more often for the regulatory equivalent of Number 8 fencing wire. It may be low tech, but it's admirably cheap and serviceable.

Northland jobs: fact or fiction?

There was, apparently, a bit of a stoush at last night's meeting of the Northland by-election candidates in Kaikohe. The National candidate Mark Osborne claimed that "seven and a half thousand" new jobs had been created over the past year in Northland, while Winston Peters asked whether anyone had actually seen one of them, and said the claim was "pulling a stunt" (you can listen to Radio NZ's piece on the meeting here, where you can hear what both candidates said).

So, who's right? It should be a simple matter to find out, and it is.

According to the Household Labour Force Survey for December 2014, the latest available data (available as an Excel spreadsheet here), the total number of people employed in Northland in December 2013 was 66,700, and in December 2014 it was 74,100, an increase of 7,400. So Mr Osborne's claim is correct. Just for the record, the other HLFS statistics on Northland also show good employment outcomes, with the unemployment rate down from 9% to 8%, and the participation rate up from 60.9% to 63.8%.

Not that Mr Osborne's version did him any good, when he went on to overegg the pudding by saying "What I will do...is to continue growing jobs". It's not clear whether the ensuing mockery was to do with him looking as if he was claiming unjustified personal credit, or because voters these days know that governments don't create jobs (or not the bulk of them, at any rate). Governments can often, and fairly, take credit for allowing or facilitating or improving the environment for job creation, and that's no small thing: just look at all the counter-examples, from France to Venezuela, where governments have been incompetent managers of the macroeconomic environment. But job creation itself? Nah.

So, who's right? It should be a simple matter to find out, and it is.

According to the Household Labour Force Survey for December 2014, the latest available data (available as an Excel spreadsheet here), the total number of people employed in Northland in December 2013 was 66,700, and in December 2014 it was 74,100, an increase of 7,400. So Mr Osborne's claim is correct. Just for the record, the other HLFS statistics on Northland also show good employment outcomes, with the unemployment rate down from 9% to 8%, and the participation rate up from 60.9% to 63.8%.

Not that Mr Osborne's version did him any good, when he went on to overegg the pudding by saying "What I will do...is to continue growing jobs". It's not clear whether the ensuing mockery was to do with him looking as if he was claiming unjustified personal credit, or because voters these days know that governments don't create jobs (or not the bulk of them, at any rate). Governments can often, and fairly, take credit for allowing or facilitating or improving the environment for job creation, and that's no small thing: just look at all the counter-examples, from France to Venezuela, where governments have been incompetent managers of the macroeconomic environment. But job creation itself? Nah.

Monday 9 March 2015

Policymaking when you don't know where you are

Last week the Reserve Bank published the latest in its Analytical Note series, 'The Reserve Bank’s method of estimating “potential output”' (pdf here). If you're into macroeconomics in general or monetary policy in particular, you probably don't need your hand held about what potential output, and the output gap, are, but in case it's passed you by, the Note explains that

The Note has two graphs which I thought were interesting. The first is a straightforward graph of where the output gap has been, where it is currently, and where the Bank thinks it's headed over the next year or two. The implication would be that the Bank needs to be watchful about potential inflationary pressures down the track, though (a) how it would tighten policy without causing the Kiwi $ to head into the stratosphere isn't obvious and (b) it's possible that inflation, for some reason we don't yet fully appreciate, isn't picking up the way it used to when economies run hot (it's a major policy conundrum in the US at the moment)..

This second one, for me, was highly thought-provoking. It shows what the output gap in early 2012 was estimated to be at the time, and how that estimate later changed as revised GDP data came to hand. Originally, the economy was thought to be running well below capacity; as more complete data came available, it became apparent that the extent of spare capacity was nowhere near as large, and even that the economy might have been running on the hot side, a bit above capacity; and on the latest data we're back to an assessment that it was running slightly on the slow side. As it happens, no harm was done - policy in early 2012 was kept at its supportive post-earthquake level, which turned out to be an okay stance to have taken - but you can see the potential for policy mistakes.

What are some of the other implications?

I'd be more charitable when assessing the performance of central bank Governors. There are plenty of trigger-happy people out there with a Gotcha! mentality: the reality is that monetary policymakers are likely doing their best in an environment of very considerable uncertainty about where are are now, let alone where we are heading next. Ditto Finance Ministers, who face exactly the same issue of assessing where we are in the economic cycle.

The uncertainty also suggests (everything else being equal) that policy is better adjusted gradually rather than in big dollops. Somewhere around the internet in the past few days I saw the analogy of driving in the dark beside a cliff: if you're not sure where you are, it's probably best to drive slowly until you get a better idea. Even if you do become easy game for the Gotcha! brigade, who will be saying you've got "behind the curve".

You'd clearly want to be careful about how much reliance you place on measures like the output gap, and you'd want to be supplementing it with all the other evidence you can garner about how hot or cold the economy seems to be (which is why the RBNZ has all those meetings with companies and organisations in between its policy decisions). It's also why I think business opinion surveys and their ilk are so valuable.

And then there's that problem of the 'true' (or 'least untrue') data only becoming evident years after it's any good for cyclical policymaking (though the data will still be fine for many less time-dependent uses). I'd like to think this will become less of an issue, in particular as we become more adept at using 'administrative' data (things like GST returns, or spending at the supermarket checkouts, that are being collected for non-statistical reasons of their own). That's the way Stats is headed, and they're right: it's likely to be cheaper, more accurate - and faster.

Potential output can be thought of as the level of activity that the economy can sustain without causing inflation to rise or fall, all else equal (for example, assuming no shock, such as big changes in oil prices). By implication, the difference between actual and potential output (the output gap) indicates the extent of excess demand, and therefore the direction and magnitude of this source of inflation pressureThis latest Note, like its predecessors, is a useful resource: I could see undergraduate economics courses using it, and maybe the more with-it secondary school classes (yes, there are some equations, but they're no biggie). There's also a one-page 'non-technical summary' at the front, so if you're the proverbial intelligent lay person that's for you.

The Note has two graphs which I thought were interesting. The first is a straightforward graph of where the output gap has been, where it is currently, and where the Bank thinks it's headed over the next year or two. The implication would be that the Bank needs to be watchful about potential inflationary pressures down the track, though (a) how it would tighten policy without causing the Kiwi $ to head into the stratosphere isn't obvious and (b) it's possible that inflation, for some reason we don't yet fully appreciate, isn't picking up the way it used to when economies run hot (it's a major policy conundrum in the US at the moment)..

This second one, for me, was highly thought-provoking. It shows what the output gap in early 2012 was estimated to be at the time, and how that estimate later changed as revised GDP data came to hand. Originally, the economy was thought to be running well below capacity; as more complete data came available, it became apparent that the extent of spare capacity was nowhere near as large, and even that the economy might have been running on the hot side, a bit above capacity; and on the latest data we're back to an assessment that it was running slightly on the slow side. As it happens, no harm was done - policy in early 2012 was kept at its supportive post-earthquake level, which turned out to be an okay stance to have taken - but you can see the potential for policy mistakes.

What are some of the other implications?

I'd be more charitable when assessing the performance of central bank Governors. There are plenty of trigger-happy people out there with a Gotcha! mentality: the reality is that monetary policymakers are likely doing their best in an environment of very considerable uncertainty about where are are now, let alone where we are heading next. Ditto Finance Ministers, who face exactly the same issue of assessing where we are in the economic cycle.

The uncertainty also suggests (everything else being equal) that policy is better adjusted gradually rather than in big dollops. Somewhere around the internet in the past few days I saw the analogy of driving in the dark beside a cliff: if you're not sure where you are, it's probably best to drive slowly until you get a better idea. Even if you do become easy game for the Gotcha! brigade, who will be saying you've got "behind the curve".

You'd clearly want to be careful about how much reliance you place on measures like the output gap, and you'd want to be supplementing it with all the other evidence you can garner about how hot or cold the economy seems to be (which is why the RBNZ has all those meetings with companies and organisations in between its policy decisions). It's also why I think business opinion surveys and their ilk are so valuable.

And then there's that problem of the 'true' (or 'least untrue') data only becoming evident years after it's any good for cyclical policymaking (though the data will still be fine for many less time-dependent uses). I'd like to think this will become less of an issue, in particular as we become more adept at using 'administrative' data (things like GST returns, or spending at the supermarket checkouts, that are being collected for non-statistical reasons of their own). That's the way Stats is headed, and they're right: it's likely to be cheaper, more accurate - and faster.

Friday 6 March 2015

When overzealous job "protection" makes matters worse

I've gone on a bit in some recent posts about the necessity of efficient, flexible labour markets - noting (here, here and here) that the labour market tends to have huge gross flows with small net outcomes, and that it's easy, with good intentions but bad policy, to stuff up the flexible working of hiring and firing. I also found some evidence that our own labour market stacks up pretty well, when considered in long-run international perspective, in keeping unemployment down.

I'd said in that last post that "if you're concerned about unemployment, you're likely to be better off if you come up with some form of social protection that doesn't impede the flexible working of the labour market, rather than reaching for some "job protection" measure that makes it harder for employers to lay people off. Making it harder to fire, for example, makes it less attractive to hire in the first place". I didn't include anything concrete to back that up, but over at his blog Jim Rose happened to be writing about some recent local court decisions which appeared to be re-regulating employers' ability to lay off staff (his two articles are here and here), and as part of his argument he'd found this.

Isn't that neat? There's a clear* link between how tightly protected existing jobs are, and how long people are stuck in unemployment before they get their next one - with the best of intentions, policymakers trying to make the labour market more secure from an employee's perspective have produced a completely counterproductive outcome. It's good to know that again our own labour market shows up to international advantage, with relatively low long-term unemployment and indeed even lower long-term unemployment than you'd expect from a country with our level of job protection. Australia scrubs up pretty well, too.

I asked Jim where the chart came from, and he pointed me to the source, a June '14 article in the IMF's Finance & Development publication profiling the career of Christopher Pissarides, who won the Nobel prize in economics for his work on labour markets and unemployment. It's a good read. From a policy point of view, the bottom line is

*I said 'clear' originally but two commenters over at The Dismal Science site said it didn't look at all clear to them, and they've got a good point. I did a rough and ready regression based on eyeball estimates of the data, and while there is a statistically significant link - a 1 point increase in the index is associated with a 3.5 month increase in duration of unemployment - it's not a strong one, accounting for only about 25% of the variance in the data. "Clear' link overstates things: there's a lot more going on as well. I'd guess a big part is countries varying a lot in the effectiveness of their 'active' labour market policies. (Updated March 17)

I'd said in that last post that "if you're concerned about unemployment, you're likely to be better off if you come up with some form of social protection that doesn't impede the flexible working of the labour market, rather than reaching for some "job protection" measure that makes it harder for employers to lay people off. Making it harder to fire, for example, makes it less attractive to hire in the first place". I didn't include anything concrete to back that up, but over at his blog Jim Rose happened to be writing about some recent local court decisions which appeared to be re-regulating employers' ability to lay off staff (his two articles are here and here), and as part of his argument he'd found this.

Isn't that neat? There's a clear* link between how tightly protected existing jobs are, and how long people are stuck in unemployment before they get their next one - with the best of intentions, policymakers trying to make the labour market more secure from an employee's perspective have produced a completely counterproductive outcome. It's good to know that again our own labour market shows up to international advantage, with relatively low long-term unemployment and indeed even lower long-term unemployment than you'd expect from a country with our level of job protection. Australia scrubs up pretty well, too.

I asked Jim where the chart came from, and he pointed me to the source, a June '14 article in the IMF's Finance & Development publication profiling the career of Christopher Pissarides, who won the Nobel prize in economics for his work on labour markets and unemployment. It's a good read. From a policy point of view, the bottom line is

“protect workers, not jobs.” Trying too hard to protect existing jobs through excessive restriction of dismissals can stop the churning of jobs that is necessary in a dynamic economy. It is better to protect workers from the consequences of joblessness through unemployment benefits and other income support—accompanied by active policies to get the unemployed back to suitable jobs before their skills and confidence deteriorateIncidentally, if Jim is right that our Employment Court "stands apart from the modern labour economics of human capital and job search and matching as well as the modern theory of entrepreneurial alertness, and the market as a discovery procedure and an error correction mechanism", maybe there's a case for it to sit with a lay member who knows something about labour economics. The High Court sits with an experienced economist, when there are major competition or regulation cases, and it's a system that works well.

*I said 'clear' originally but two commenters over at The Dismal Science site said it didn't look at all clear to them, and they've got a good point. I did a rough and ready regression based on eyeball estimates of the data, and while there is a statistically significant link - a 1 point increase in the index is associated with a 3.5 month increase in duration of unemployment - it's not a strong one, accounting for only about 25% of the variance in the data. "Clear' link overstates things: there's a lot more going on as well. I'd guess a big part is countries varying a lot in the effectiveness of their 'active' labour market policies. (Updated March 17)

Tuesday 3 March 2015

Our labour market in perspective

I wrote a piece the other day, basically saying that, if you're concerned about unemployment, you're likely to be better off if you come up with some form of social protection that doesn't impede the flexible working of the labour market, rather than reaching for some "job protection" measure that makes it harder for employers to lay people off. Making it harder to fire, for example, makes it less attractive to hire in the first place.

Since then I was browsing on the excellent Vox site, which is where the Centre for Economic Policy Research posts shorter version of its research papers (the papers themselves are, sadly, only available by subscription, through you can see the titles and read the abstracts here). And I came across a piece by Jan van Ours, a professor of labour economics at Tilburg, that was mostly about other things but happened to throw a little light on how well our own labour market is performing. It included a graph (below) which compared unemployment rates in a range of countries in 1985 and 2013, the years being chosen because they were at a roughly similar point in the global economic cycle ("a couple of years after the 1980s recession and the Great Recession respectively"). The chart's not perfect - Ireland for example happened to be in a tight cyclical spot in both years, for different reasons - but it's still a good general guide to which countries had persistently low or persistently high unemployment.

Some countries can burden themselves, more or less permanently, with labour markets that work systematically badly, and other countries have devised labour market regimes where unemployment tends to be systematically low. Or as the author says, "Clearly, despite the difference of 28 years, the unemployment rates in the two years are highly correlated across the countries. Spain has the highest unemployment rate in both years whereas Austria, Japan, Norway, and Switzerland have the lowest unemployment rates in both years", and, I'm pleased to say, we're in the same neighbourhood as the good guys. We've got a system that works, by international standards.